Local officials push to change ‘unfair’ delinquent property tax process

Published 11:01 am Thursday, October 4, 2018

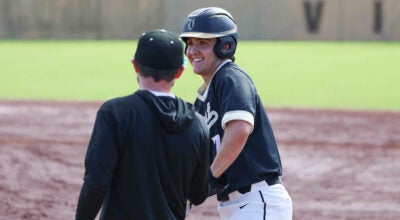

- Alabama Rep. Corley Ellis, left, and Shelby County Property Tax Commissioner Don Armstrong were instrumental in rewriting state law about collecting delinquent property taxes. (REPORTER PHOTO/STEPHEN DAWKINS)

COLUMBIANA – Shelby County is at the forefront of a new, more fair process for collecting delinquent property taxes.

Shelby County Property Tax Commissioner Don Armstrong was instrumental in the adoption of a new state law that allows counties to collect delinquent taxes through the auction of liens against the properties—instead of auctioning the properties themselves—and in April 2019 the county will become the first in Alabama to hold such an auction.

Previously, properties for which taxes had not been paid were subjected to an auction held in front of the Shelby County Courthouse each spring.

The process caused problems for property owners, including having to repay “excess” bids.

Bidders—which are often representatives of large national investment companies—could actually bid a certain percentage over the amount of taxes owed.

When combined with fees and interest on the amount the bidder ultimately paid, the property owner could face a bill several times the original amount of the taxes if he or she wanted to redeem the property.

“It’s just an unfair thing,” Armstrong said and added that county must account for the overbid funds, which creates extra work and can be a source of lawsuits. “That’s what prompted me to push for, we need to get something done here. There are a lot of bad pieces to that tax sale for the taxpayer.”

Armstrong said he worked with Baldwin County Revenue Commissioner Teddy Faust and Charles Luker, a retired tax official from Coosa County, to rewrite the state law on delinquent property taxes.

They found that 39 states hold tax lien auctions and set about drafting provisions for counties in Alabama to do the same.

“This is a change from what Alabama has done altogether,” Armstrong said.

Armstrong and Faust visited Yuma County, Arizona, for two days to witness a property tax lien auction and came back even more convinced that it was a preferable system.

Armstrong said he approached Alabama Rep. Corley Ellis, a long-time friend whose office is a short walk from Armstrong’s, about sponsoring the bill.

“Being in real estate, I had watched these tax auctions and was not a fan of the overbid system,” Ellis said about the first bill he sponsored as a legislator. “I felt like that was putting an extra burden on people who were already having a hard time paying their property taxes.”

Bill Justice helped write the legislation, which took six to eight weeks to prepare, and it was introduced in the Legislature in February.

The process of getting a bill passed is often an arduous one, and when Ellis introduced his bill, he did not expect it had much of a chance of passage until the next legislative session.

“It started gaining momentum because it’s such a good thing to do,” he said.

After about a month of readings and committees, Ellis answered questions from fellow lawmakers on the floor of the House of Representatives, and the bill passed 96-0 in the House and 29-0 in the Senate.

“It’s going to make it easier for taxpayers to redeem their property, and that should be the end goal,” Ellis said. “It will be better for counties, it will be better for the citizens of the state of Alabama, it will be better all the way around.”

In a tax lien auction, using a reverse auction format, bidding starts at a certain percent interest over the amount owed—in Alabama it will be 12 percent—and goes down from there. The bidders determine how small of a potential margin they are willing to accept based on what they know about the property, and property owners are never stuck with a bill that far exceeds the amount of taxes they owed, as was common under the old system.

Some aspects of the process will remain similar. There will still be a time period during which the owner can clear the property, but instead of redeeming ownership of the property, now the owner will look to avoid the lienholder beginning foreclosure proceedings after three years.

Property taxes are due Oct. 1 of each year and considered delinquent if not paid by the following Jan. 1.

A property owner must pay off the tax lien against his or her property before the following year’s taxes can be paid.

If a lien goes unsold during the auction, a county’s tax collecting official can sell the lien privately.

Armstrong and Ellis said the criticism they heard most often is that the law makes the tax lien sale optional and not mandatory for each county, but Ellis said he had secured the support of tax officials across the state based on them being able to adopt the new process on their own timetable.

The Shelby County Commission unanimously passed a resolution in support of the tax lien sale in August, and Armstrong began preparing to conduct the first one in the state’s history. He expects tax officials from across the state to attend.

“I never intended to do another tax sale,” Armstrong said. “You have got to have a way to collect delinquent taxes, but we shouldn’t be in an investment situation.”